UST Crash Explained

What are UST and LUNA?

UST is an algorithmic stablecoin, which means it holds value based on an algorithm that is coded in the smart contract and is not backed by any real-world asset. Instead, it is backed by LUNA Token. LUNA is a native token of the Terra blockchain network, which allows users to participate in governance, peg stablecoins, etc.

How does stablecoin work?

Stablecoins work on four different methods namely fiat-backed, crypto-backed, commodity-backed, and algorithmic

Fiat-backed:

USDT and GUSD are the two examples of Fiat-backed stablecoins, which are pegged to real-life assets or commodities to ensure stability in value and lower volatility in the market. Investors use these stablecoins to protect themselves against the volatility in the market.

Algorithmic:

UST is an example of the algorithmic stablecoin. These types of stablecoins will not use fiat or cryptocurrency as collateral. Instead, it uses algorithms to determine the price. These algorithms are written in a form of code in the smart contract and deployed in the blockchain. An algorithmic stablecoin works in a way that the system will reduce the number of tokens in circulation when the market price falls below the price of the fiat currency it tracks. Alternatively, if the price of the token exceeds the price of the fiat currency it tracks, new tokens enter into circulation to adjust the stablecoin value downward.

How does UST manage its peg?

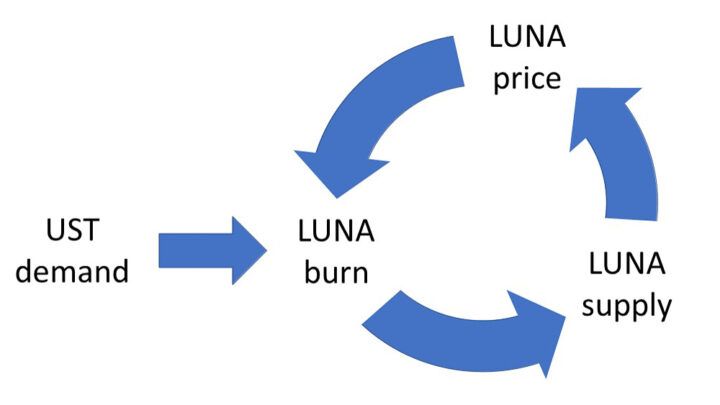

Let’s say the price of UST is $1. If we want to buy 100 UST, we need to pay $100 USD or we have to burn $100 equivalent of LUNA token. Let us assume that the price of 1 LUNA is $50. So if we want $100 worth of UST, we need to burn 2 LUNA tokens(2 x $50). If the market price of UST is less than $1 per token, the minting conversion rate treats one UST as equal to one dollar. This exchange mechanism ensures the price stability of UST.

But what could go possibly wrong with this method? That is where the Anchor protocol comes into play.

What is Anchor protocol?

Anchor protocol is created and maintained by Terraform labs. The project is run by the community and provides a lending and borrowing platform for Terra users. Through over-collateralization, you can earn interest, borrow, and lend crypto with Anchor Protocol.

When users stake UST in the Anchor protocol, it gives them 20% interest. Probably this is the starting point of this whole problem.

What exactly is the problem?

On 7th May, Over $2 billion worth of UST was unstaked (taken out of the Anchor Protocol), and was sold immediately. This huge sell pushed the price down. Now traders took advantage of this situation by Buying the UST for $0.90 and swapping it for $1 of the LUNA token. While $1 doesn’t sound like much, bigger profits can be made on a larger scale. As UST lost its peg, the network created more LUNA. when huge LUNA tokens flooded into the space, the demand eased out. Therefore, the price was negatively impacted heavily.

Worried about attackers targeting your smart contracts? Contact us today to get your smart contracts audited for any security issues!

Yuvarajan

is working as a security engineer in Detasecure. He can able to perform memory forensics and can able to analyze malware. He has done B.E from Anna University. He is an active participant in capture the flag (CTF) competitions. You can reach out to him by Clicking Here.